Tax season is coming up, and it’s about time to bust some myths.

“If you’re educating voters, you’re losing elections.” —John Dennis

Darn. No wonder I placed last in my assembly run.

At the Trump Rally in a Reno casino a few weekends back, Trump reminded us of his promise to, if elected, impose “No Tax on Tips! No Tax on Overtime!” and the crowd thundered. I wept internally.

When Lazarus died, Jesus wept. Some interpreters say that he wept because Lazarus died. To me that never made sense, because if Jesus knew that Lazarus could be re-awakened. Did Jesus weep because of ignorance?1

Piling on to this ignorance of income taxes is the many, many “Patriotic”, “America-First”, “Constitutional”, “Conservative”, and similarly bent influencers, educational institutions, and “experts” in the field that either say the Income Tax is unconstitutional and should be abolished (as I once believed— Trump is now floating this idea, as mentioned on his Joe Rogan podcast) or that nobody is above the law; that the Citizen is, effectively, property of the United States Government and must pay his fair share as part of a Lockean feudal bizzarro social contract.

When I started writing this three-part series on the Income Tax, I was not yet fully convinced that the Income Tax was not unconstitutional. Luckily, I wrote the series in reverse order, starting with the most technical. My first draft of the article you’re now reading, which I wrote during days as a financial coach, was titled “Income Tax is Unconscionable: An Unconscionable Law is Unconstitutional,” and had I published it as it was, I would have added to the heaping pile of ignorant garbage. I have included that ignorant garbage herein for your convenience and edification.

Even after writing and publishing parts 2 and 3, I learned more and had to update the posts with corrections. It is not that the entire article is incorrect, only certain parts. 95+% of the information remains useful as they are direct quotes from the law and tax forms, as written.

In order to know the law, you must know how to read the law.

The Constitutionality of the income tax [This article]

Withholding Requirements according to USC Title 26: Internal Revenue Code

Income Tax Liability according to USC Title 26: Internal Revenue Code

So, let us begin this article with the original draft in progress, which would be valid if the Income Tax laws were actually what people think it is.

I’m going to say it again…

NOTICE:

THIS NEXT SECTION IS MISLEADING. It is not reflective of the actual law. It is based on the public mis-opinion that the Income Tax applies to ALL incomes of ALL People who live or work in one of the 50 states, the District of Columbia, or other American or Federal territory, or are subject to the income tax simply because they are US citizens.

Draft: Income Tax is Unconscionable

An Unconscionable Law is Unconstitutional [Original Draft for this Article]

The allure of being rich revolves around a single idea: the ability to create the life that you want with one less restriction: Money.

“Lots of people say they want to be rich, but few do anything to make it happen”

Well, that’s because the dream has been confused and substituted. People want to not worry about money, which is a very different thing than having a large net worth. Hard work, one small upgrade at a time, with, every so often, a big upgrade, is what we naturally work towards. At least, that’s an observation of my own life. And work is only accomplished over time.

Put another way, when your dream is desirable enough, the only thing that’s really in between you and it is time. For if you work towards the dream, it will be accomplished at some point in time.

Consider one of your dreams. How long do you need to accomplish it?

Many variables can go into it. However, for sake of this explanation we look at the question from a purely financial point of view, so our variable is money over time, which we can call “money velocity.”

For example, if your dream is to buy a house, an objective of yours may be to get enough money for the down payment.

A greater velocity decreases the time needed to accomplish the objective.

We can model this with a simple theoretical example, as such we learned in grade school:

Tom and Sherry have a dream. They need $100,000 to accomplish an objective towards the dream. Tom is currently broke and has a money velocity of $700 per month. Sherry has $20,000 to start and a money velocity of $300 per month. How long will it take for Tom and Sherry to accomplish their objective?

We can skip the fun part, because calculation is not needed to make this point. The bottom line is, obviously, that it will take time. 80 months to be exact, assuming no money velocity changes. Time is a finite resource. To steal someone’s time is to rob them of their life.

The Income Tax steals your time.

Tom is currently broke and has a money velocity of $700 per month, or $595 after income taxes. Sherry has $20,000 to start and a money velocity of $300 per month, or $18,000 and $270 after capital gains and income taxes, respectively.

The Income Tax steals your time in the form of money.

It is a work siphon.

Now, even though there is no change to the amount of work applied towards the objective, of the it’ll take them 95 months.

The federal government has stolen 15 months of Tom and Sherry’s time simply by existing. What exactly did they do to lay claim to 15% of Tom’s and 10% of Sherry’s assets and income? What right do they have to your hard-earned money?

“Well, they protect us from invasion, build and fix the roads, operate schools, and provide all kinds of other services with our tax dollars.”

All of those things are provided for by other taxes, most of which you cannot avoid paying, particularly if you use said services. Property tax (although this too is questionable), gas tax, tolls, sales tax, licenses, and so on. The Income tax is just one in a long list.

Wait a minute…

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, …

—Declaration of Independence

How does taking a portion of our labor for themselves constitute protecting our right to Life and pursue Happiness? If it takes Tom and Sherry 15 more months because of the tax, isn’t that directly in opposition to our foundational principle, including the three enumerated rights?

What about the Constitution?

We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America.

—US Constitution, Preamble

Well, I can see that feudally taking a portion of one’s hard work does not promote the general Welfare, and restricts your liberty because more of your time, which also means more energy, sweat, and hardship will be required. The purpose of our government is to promote life, not take it away (though that’s all it seems to be good at lately).

Any thing that does not agree with the Constitution is null and void of law:

This Constitution, and the Laws of the United States which shall be made in Pursuance thereof; and all Treaties made, or which shall be made, under the Authority of the United States, shall be the supreme Law of the Land; and the Judges in every State shall be bound thereby, any Thing in the Constitution or Laws of any State to the Contrary notwithstanding.

—US Constitution, Article VI Section 2

So, if you consider the “income tax laws” that have been “passed,” you must quickly realize that they decrease your money velocity. All things being equal, it will take you longer to fulfill your dream if taxes are due on each dollar you earn with your time spent.

Sounds very unconstitutional to me.

[End Draft]

Ok, now that the whiny, complainy, woe-is-me part is done with, we can get back to reality.

I hope you enjoyed the draft. Similar types of argument and reasoning are often employed to make you believe what isn’t is. It’s emotional. You may have felt something when you read about how unfair the income tax scheme is. In your emotional state, you may end up doing stupid stuff, like sending the IRS a drawing of a middle finger in response to a proposed assessment.2

Reality: The Income Tax is 100% Constitutional

First, I would like to applaud and recognize the efforts and commitment of those who have worked so hard to bring the light to this matter.

Peter Eric Hendrickson, author of Cracking the Code and owner of LostHorizons.com, has put together a tremendous resource that is indispensable for anyone wanting to file their taxes properly. Then there are the thousands, out of hundreds of thousands, of Americans who have properly filed returns and shared their victories for us to see.

Peymon Mottahedeh, owner of Freedom Law School, has done a great job in educating people about the realities of tax law, and has put together petitions that you can send to your representatives in Congress so that they either open an investigation into misapplication of tax law or change the code’s language so that it is less confusing. While some of the FLS methods, advice, and conclusions lack substance, the work they are doing is overall beneficial to the cause.

The internet has also been a monumental help. Searching, understanding, and constructing the code is made so much easier when you can search the entire thing in under a second. Had we been reliant on physical matter, this information would have been, essentially, hidden. Today, you can discover the reality of our tax laws in the warmth of your own bed with a laptop.

Second, I’d like to applaud and recognize the probably thousands of people, over the course of many generations, who have worked so diligently and so consistently to mislead the public into thinking what isn’t is, and what is isn’t. I’m not saying that they have done a good thing— quite the contrary; we would be better off as a nation without their works of confusion and deceit. It is not easy to make people ignorant, but they have done a tremendous job at it. Wars, droughts, infiltration, mass societal upheaval… Their success has been so tremendous that the scheme became self-perpetuating and is now self-preserving amongst the people. Proof check: ask your CPA about what you learn here today.

And all this they’ve been able to pull off, all while keeping the income tax laws 100% constitutional.

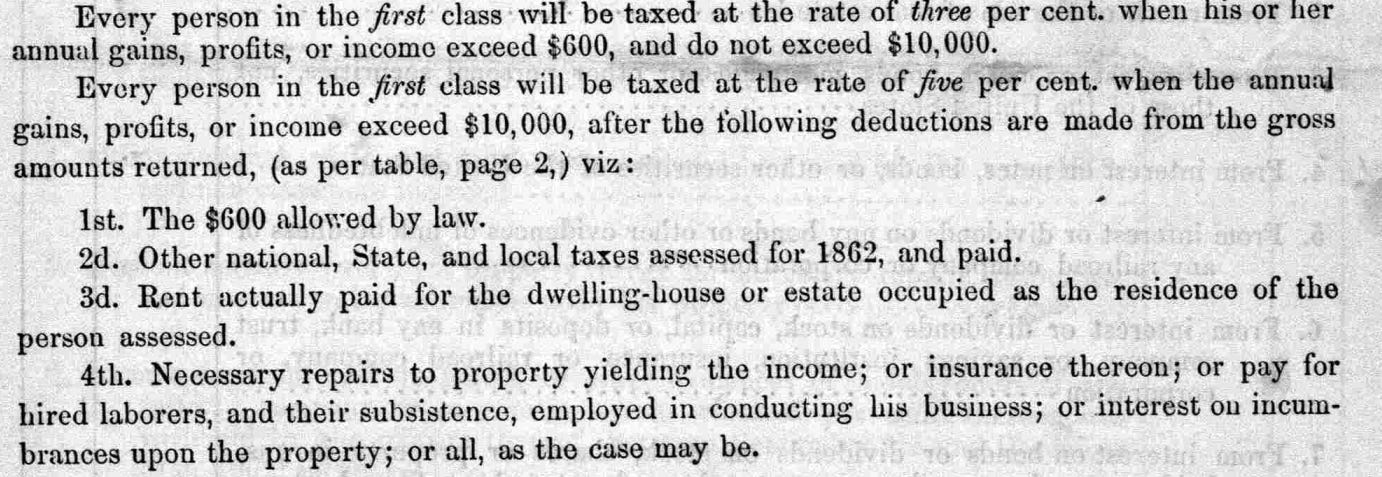

The 1862 Income Tax Return

A good place to start, in part because many people incorrectly are led to believe— as I was— that the income tax started in the early 1900s alongside the creation of the Federal Reserve and passage of the 16th Amendment shortly after a supreme court ruling ruled the income tax unconstitutional. We’ll bust that myth shortly.

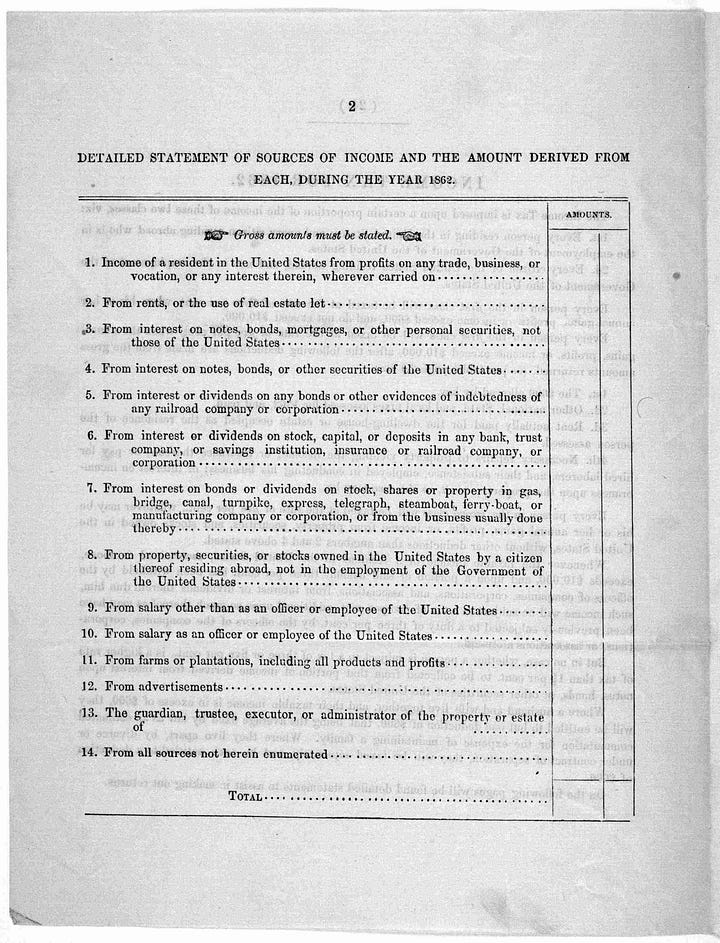

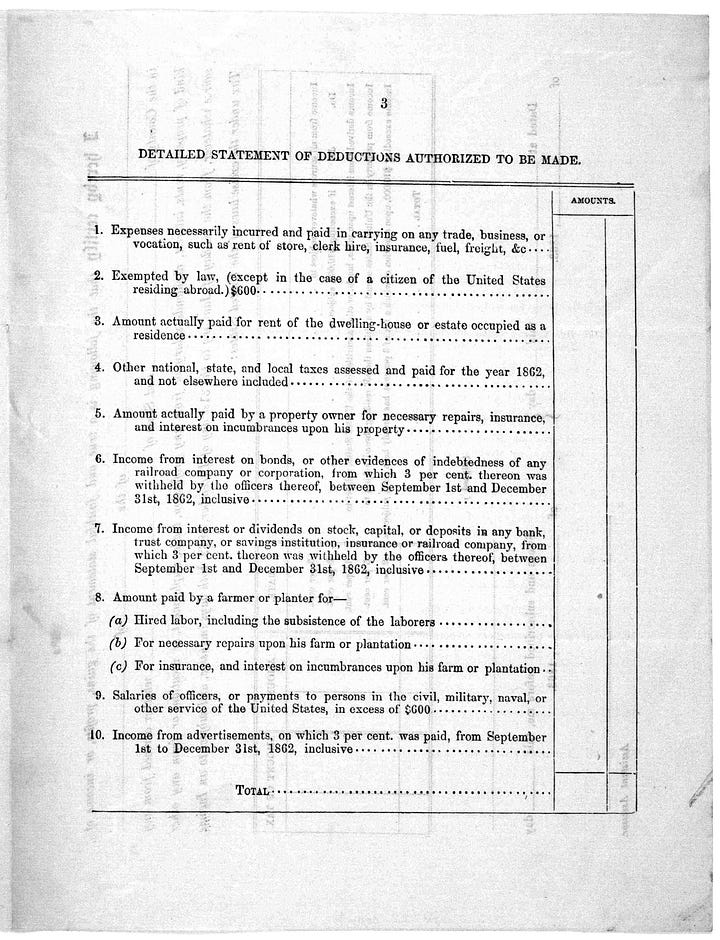

First, we’re going to review the very first return that our current income tax system is based on and notice some things about it. This exercise will help when you’re looking into the current evolution of the code, because this is the starting point. When the Internal Revenue Code was approved in 1939, it was an aggregation of a bunch of different revenue laws that had been passed over time.

The whole body of internal revenue law in effect on January 2, 1939, therefore, has its ultimate origin in 164 separate enactments of Congress. The earliest of these was approved July 1, 1862; the latest, June 16, 1938.

—Preface to the 1939 Internal Revenue Code3

The 1862 Return is four pages long.

The first thing to note is that the Income Tax is imposed upon… INCOME! Not on people or persons. Keep this in mind. It’s very important, you see.

The tax is imposed on two classes of income:

“Every PERSON residing in the United States; and every CITIZEN residing abroad who is in the employment of the Government of the United States”, and

“Every CITIZEN of the United States residing abroad, and not in the employment of the Government of the United States.”

My first set of questions for you:

What’s the difference between a PERSON residing in the US, and a CITIZEN residing abroad employed by the US Government?

Why are they grouped together?

Why would a CITIZEN residing abroad not working for the US Government be in a different category?

Is the income tax imposed on the PERSON/CITIZEN or on the income of the PERSON/CITIZEN?

How many US citizens lived abroad in 1862?

Let’s use some live examples to figure out who’s what and what’s where. Into which class do the incomes of these people fall?

Paul, a US citizen, living in California, founder and owner of a machine shop.

>Well, he doesn’t reside abroad, and he’s not employed by the US Government… So must be a person as described in class 1.Jenny, a US citizen, lives in California and is serving her second term in the US Senate.

>Works for the US Government, and is a citizen. But, she doesn’t reside abroad… Must be a person, just like Paul. Class 1.Frank, a US citizen, living in France because he was appointed to be the ambassador to France.

>Easy! A citizen residing abroad working for the US Government. Class 1Margot, a French subject, employed by Napoleon III as his personal chef.

>Also easy. Nothing to do with the United States. None of the above.Pierre, a US citizen, employed by Napoleon III as Margot’s sous-chef.

>Well, he must be in class 2 because he’s a US Citizen residing in France, not employed by the US Government.Ronald, a retired US citizen, living in Portugal off of dividends from stock in a US Government-created corporation.

>Easy. US Citizen living abroad who does not work. Class 2.

Immediately we run into a problem, because this makes no common sense at all. We’ve used our colloquial understanding of the terms used to classify these people, and something is definitely wrong.

First problem. Margot’s income is from the same source as Pierre’s, and it is non-taxable. If you are now to say, “Well, that’s because Pierre is a US citizen, and he needs to pay his fair share of US tax!” then you’re claiming that (1) the United States is Pierre’s feudal overlord, (2) just because the United States exists, Citizen Pierre owes it a portion of the fruits of his labor regardless of how it’s made, and (3) the Revolutionary War was fought for naught.4

Further, Pierre’s income from active labor is taxed the same as Ronald’s, whose income is passive from a US Government corporation. Pierre’s income is independent of the US Government’s existence, while Ronald’s income would be impossible without it. What common sense does that make?

Over in California we have a rhyming situation. Paul, whose income is also the result of his own labor, and Jenny, who makes money from the public purse, are taxed the same class because they are both “persons”, right? Somehow, that does not sit right.

We have some conclusions to draw.

That is— “Person”, “citizen”, “residing”, and “abroad” must mean something different than what we’re used to.

Let’s explore these, in no particular order.

If “every person residing in the United States” meant “every person living in the United States,” then the only distinction left is whether or not citizens living outside the US work for the US Government, because “every person residing in the United States” would include people who live in the United States whether or not they work for the US Government.

So, “Every person residing… ” cannot mean “Every man or woman living… ”

I found a relevant hint as to what “resides” means while reading the case American Airways v. Wallace, 57 F.2d 877 (M.D. Tenn. 1932). The sixth paragraph begins:

“Plaintiff is a nonresident corporation, and a common carrier, engaged in the business of hauling and transporting freight, passengers, and the United States mails, by aeroplane from points outside the state of Tennessee to cities within the state of Tennessee, and from points within the state, to points outside thereof.”

Plaintiff, American Airways, Inc., now American Airlines, is a nonresident corporation.

But wait, at the time of this case, American Airways was an American company, based in Tennessee, so why call it a nonresident corporation?

Could it mean that Tennessee is “abroad” from the United States? Is the United States the ten square mile District mentioned in Article I Section 85 of the US Constitution where Congress has power to “exercise exclusive Legislation in all Cases whatsoever over such District”?

Jurisdictionally, is Tennessee “abroad”?

Perhaps we will find hints if we continue reading the 1862 Income Tax instructions to see how the incomes of these two classes are taxed:

Reminder: The first class includes "Every PERSON residing in the United States; and every CITIZEN residing abroad who is in the employment of the Government of the United States"This is very similar to the income tax brackets we enjoy today: progressive.

0 to $600 — 0%

$600 to $10,000 — 3%

$10,000 and up — 5% after deductions

Do you think the second type of the first class of tax is meant to apply only to US citizens who work for the US Government and live in France, England, or some place other than in one of the union member states? Indeed, that’s what it must mean if it is true that “every person residing in the United States” means everyone living in one of the union member states or other American territory.

Let’s have a look at the tax imposed on the second class:

Reminder: The second class includes "Every CITIZEN of the United States residing abroad, and not in the employment of the Government of the United States."Basically a 5% flat tax, with certain deductions allowed.

Do you think this second class of tax is meant to apply only to US citizens who are non-government workers living in France, England, or some place than in one of the union member states? Does this make any sense? Why would congress write such convoluted rules? How many US Citizens were living abroad in 1862 anyway?

Take a careful read of the highlighted and underlined portions above. It says, rephrased, “Every [citizen of the US residing abroad who is not a US Government employee] will be taxed [on] his or her annual gains, profits, or income from [assets] owned IN the United States.” Sounds to me that the only thing that is taxable of citizens living abroad is what they own back home.

Recalling the learnings from the Constitution 101 class helps shed light here.

The United States of America is a public trust corporation, and you can earn income from corporations. Corporations can own land, rent land, sell land, rent property, issue bonds, establish national banks that pay interest, pay unemployment, give food stamps, create corporations in which you can buy stock whose stocks pay dividends, and also pay people who do work for it— officials, employees, contractors.

Colloquially, we say, “I own stock IN Coca Cola, and they pay me dividends.” In the same way, you can receive gains, profit, and/or income from being invested IN the United States [Corporation].

I see no other option but to conclude that corporations created by the United States [Corporation] are resident corporations. Other corporations, like American Airways based in Tennessee, are nonresident corporations. “Person” includes a corporation, among other things.

26 U.S. Code § 7701 (a)(1) The term “person” shall be construed to mean and include an individual, a trust, estate, partnership, association, company or corporation. 1 U.S. Code § 8 (a) In determining the meaning of any Act of Congress, or of any ruling, regulation, or interpretation of the various administrative bureaus and agencies of the United States, the words “person”, “human being”, “child”, and “individual”, shall include every infant member of the species homo sapiens who is born alive at any stage of development.

So if you are a “person residing in the United States,” you could be US Government Airlines, a fictional airline company I just made up that was created by the US Government, or a born alive baby. (Feds taxing child labor?)

We can take it that “reside” means to be a creation of or wholly subject to. Such as is the relationship between serf and lord. The serf resides on the lord’s land doing the lord’s work.

Applying common sense to our founding principles makes it clear that all people living in one of the union member states, or even congress’s District, is not created by or wholly subject to the federal government. It is very unlikely that YOU reside in the United Sates.

Now, if you start a farm on federal land, that would make you a resident in the United States; you’re occupying the land for some time to do permitted business. During that time, your relationship to the government is like that of a serf and lord. You probably had to get permission to use the land to begin with, and then the US government can limit what type of crops you grow, how much you can grow, and other uses of the land.

Now, what if you buy your own land and move your farming operation there, and then open up a machine shop because you can do what you want on your land? You now reside outside of the United States. You are abroad; outside of the jurisdiction of the US Government, just like American Airways, Inc.

So now, let us update our definitions and revise our table, making sure that people are taxed according to law.

Jenny’s, Frank’s, and Ronald’s incomes are all derived from United States [Corporation] sources. Paul’s income is not. Nor is Pierre’s. Their incomes are not of a class subject to the income tax.

We switch Jenny’s classification to be a US citizen rather than a person residing in the United States, because she lives in California, and with respect to the United States [Corporation], is a nonresident, just like Frank and Ronald.

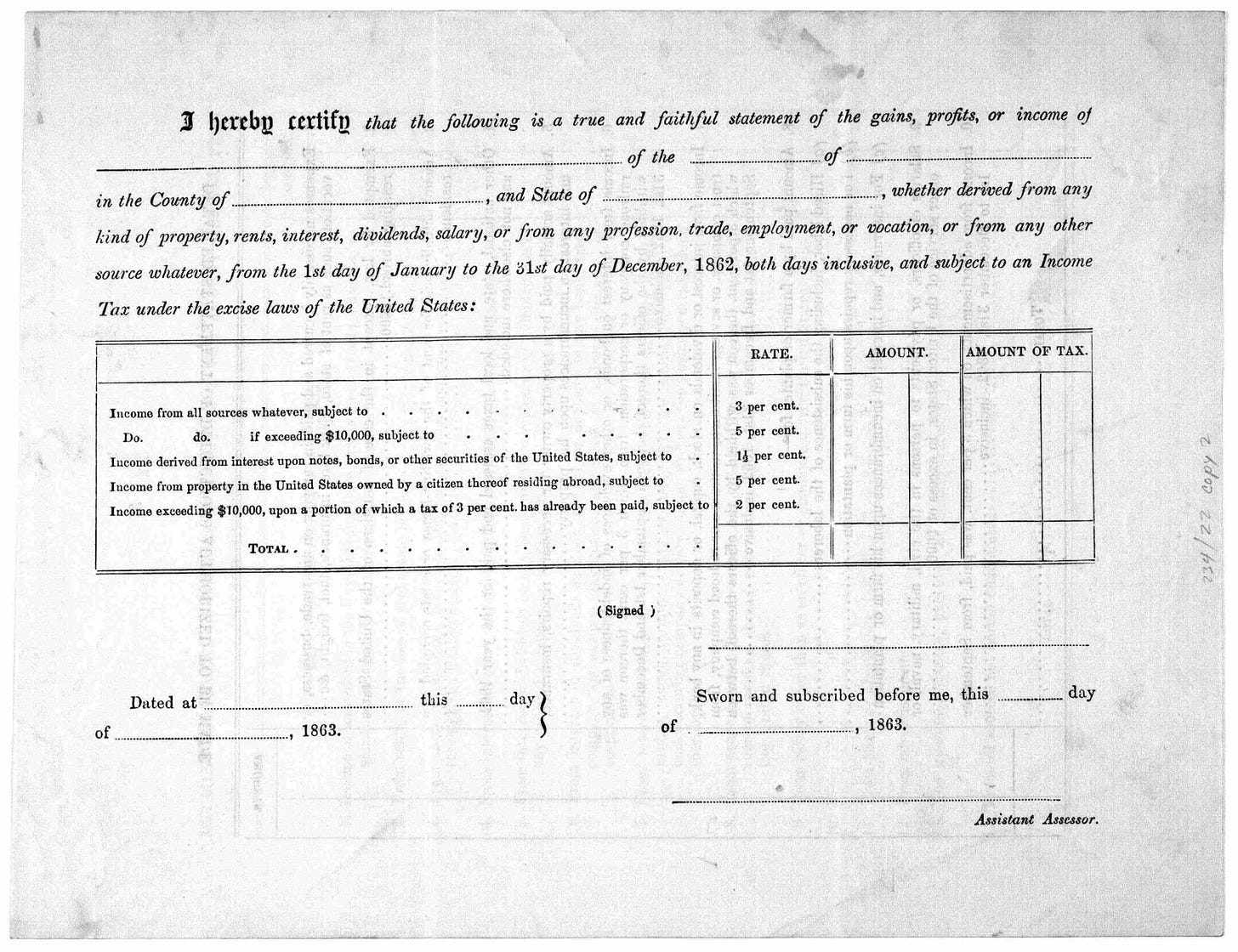

The second and third pages are where you detail your incomes:

The final page contains the certification, which helps confirm what we found out from analysis of the first page:

You certify the statement and calculation by saying “I hereby certify that [my correctly detailed gains, profits, or income] are subject to an Income Tax under the EXCISE LAWS of the United States.”

“The terms "excise" tax and "privilege" tax are synonymous, and the two are often used interchangeably.

—American Airways v. Wallace, 57 F.2d 877 (M.D. Tenn. 1932)

In other words, the Federal Income Tax is a tax on gains, profits, and incomes derived from the privilege of doing business with the United States [Corporation].

It is for this reason Peymon says that 99% of Americans are not required to file and pay federal income taxes and thousands of those in the 99% have gotten full refunds of all that was withheld from them by filing educated returns.6

So, then, this all begs the question…

How did it all go so terribly wrong?

I could write a whole bunch about this, but it all boils down to two things.

Propaganda and Ignorance. (Which came first?)

Nowadays, fear keeps people in check. Are you going to change how you file your taxes? Why?

Nowadays, there are many people who believe, as I did, that the income tax is unconstitutional. Yet they still file and pay. Why?

There are many people who see that government is doing all kinds of bad things, including trying to kill them in very expensive ways. Yet they still file and pay. Why?

Now, you, reading this, are aware that the income tax is 100% constitutional, but your income is likely not taxable. Will you still file and pay as you have been?

The time comes now to ask yourself the question: Will I encourage my government to obey the law? Or will I continue voluntarily sending my hard-earned money to a Government that’s promoting mass arbitrary eugenics and genocide, enriching the worst kinds of people in the process?

Maybe you should not have read this far. Maybe you will knowingly file an incorrect return next year just to keep big bad government off your back. You don’t want one of the 87,000 new IRS agents you’ve heard about in the news to come after you.

If that’s you, I leave you with one of Samuel Adams’ messages:

“If ye love wealth better than liberty, the tranquility of servitude better than the animating contest of freedom, go home from us in peace. We ask not your counsels or arms. Crouch down and lick the hands which feed you. May your chains set lightly upon you, and may posterity forget that ye were our countrymen.”

If that’s you, you hereby also forfeit all rights to complain or be angry about how oppressive and unconstitutional our income tax system is, out-of-control government spending, social security, and the national debt. The power to do your part to fix all of that is in your hands. Your job is to act on the knowledge you now have, and share the knowledge so that others also have a chance to act.

Government grew fat, lazy, and lawless because we grew fat, lazy, and lawless. Government is a reflection of the People.

Government is by the People, of the People, for the People.

It’s time to choose. A moment of truth is in front of you.

But maybe you are one of the many who want to right the ship. The immediate benefit is that you get is a 20-40% raise at work without having to get a raise or take on more responsibility. Filing educated returns is great! Of course you may encounter roadblocks. The taxing agencies have been known to encourage complacency, compliance, and ignorance through threats and intimidation. Of course they would, it’s free money to them! I just filed my taxes properly for the first time in my life, and am due a refund for overpayment— everything that was withheld from my paycheck in 2021. I’m eagerly awaiting their response.

So, what will you do?

If knowledge and application of tax law, as written, became commonplace, our government would be forced to get its act together. It would be forced to cut unnecessary spending. The gravy train would end. What you would do if your monthly income stream was cut by 80%? I imagine you would cancel a lot of subscriptions you didn’t even realize you had, downsize your spending habits, and be more mindful and precise about where your money goes.

Everybody wins when you enforce the law.

The Federal Reserve and the 16th Amendment

It is commonly reported that the income tax began in the early 1900s enabled by the ratification of the 16th Amendment.

16th Amendment

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Well, well, well. Taken by itself, it really does seem like Congress has been given the power to lay and collect taxes on all that comes in, no matter how it comes in.

But what if I told you that this, too, has been taken out of context and parroted by [useful] idiots to get people going down all kinds of troubling paths? Would that surprise you? Given

But I have two questions for you.

Given that this is an amendment to existing law for the United States of America [Corporation], could it be important to understand the surrounding context as to why the amendment was added that most people peddling this conception myth conveniently leave out?

Consider and compare the average literacy of men now and in 1913. Was Grandpa really a moron?

The linked articles in the first and second question is included by reference as though fully stated herein.

Part 2:

Part 3:

Further reading:

If you have the desire to learn what tax law actually says and how to file your tax returns properly, this is an indispensable resource. It is free to read, or you can buy yourself a physical copy, as I have:

There are several other similar instances. In one, the storm was going wild and Jesus was taking a nap. His disciples, terrified, woke him up, to hear him say, “Why are you afraid, ye of little faith?”

Another, Jesus went away for a while and told his disciples to watch and pray. When he returned, he found them sleeping, and said, “Couldn’t you even hang out for an hour?”

A lot of effort is put into keeping the income tax ignorance fraud scheme going, not just by the IRS, but also the millions employed in the massive industry that has built itself up around the income tax ignorance fraud scheme. And of course… their jobs depend on it.

Found in UNITED STATES STATUTES AT LARGE, 1939, Volume 53, Part 1, Internal Revenue Code. Link to Book on Google Books.

If the United States ceased to exist, Pierre could continue working for Napoleon without being taxed by those pesky US revenue collectors. Perhaps that’s what Pierre is scheming 👀

“The Congress shall have Power… To exercise exclusive Legislation in all Cases whatsoever, over such District (not exceeding ten Miles square) as may, by Cession of particular States, and the Acceptance of Congress, become the Seat of the Government of the United States, and to exercise like Authority over all Places purchased by the Consent of the Legislature of the State in which the Same shall be, for the Erection of Forts, Magazines, Arsenals, dock-Yards and other needful Buildings”

— US Constitution. Article I Section 8

The beneficiaries of widespread ignorance enjoy free money, so yes, sometimes the tax collectors throw a fit