"Employee" "Wages" | Legal v. Formal English

Part 2/3: US Code Title 26 Review | Filling out Form W-4 according to the Instructions and law

UPDATE 31-May-2024:

There is more to the story! As always. As I learn more, the more I realize my past conclusions are faulty.

In this article, I outline steps for how to fill out a W-4 if you have no income tax liability, by writing ‘EXEMPT’ in the appropriate space on the W-4 as the instructions dictate.

However, this is not the correct way of doing it. Please see the section titled ‘Some Further Thoughts Regarding Withholding And W-4s’ here: https://losthorizons.com/appendix.htm

When I share with people what I’ve discovered about most people not being liable for income taxes, and that the way you voluntarily give your money away is by declaration on the 1040 confession form, a common response is,

“But I’m getting money back, so it’s ok; and if I don’t file, then I lose out on that money”

Valid point. Taxes are withheld from your paycheck by your employer because you have asked them to ship your money into the void by— guess what— another declaration that you made when you started the job. It’s made possible by yet another one of those “required” forms.

So, today we are going to have a look at that form, and see what its instructions and the law actually says about who needs to request withholdings, just like we did in the previous Title 26 Review.

If you haven’t read that yet, read this one first, as this is part 2 of a 3-part series:

Withholding Requirements according to USC Title 26: Internal Revenue Code

Income Tax Liability according to USC Title 26: Internal Revenue Code

Yes, I wrote part 3 first, and will write part 1 last. I’m doing this backwards because that’s the world right now. Ass-backwards.1

Special thanks to the team at FreedomLawSchool.org, who helped put this together, and educating people about tax law.

Introducing Form W-4

When you start a job, your employer will most likely have a whole bunch of onboarding tasks for you to do. One of them will undoubtedly be something called a Form W-4: Employee’s Withholding Certificate.

Immediately, notice that this is a certificate. What is a certificate?

You, the sovereign, who has unlimited ability to contract, are attesting/declaring the law and facts into existence, right there in step 5 where you sign under penalty of perjury. How very nice of them, to provide you with an easy-to-follow form to help you make law.

Very early on in the form instructions, we find a section called Exemption from withholding. The purpose of Form W-4 is “so that your employer can withhold the correct federal income tax from your pay.”

Notice: Obviously, not everyone is required to pay United States federal income tax, such as French citizens living and working in France, so there exists within the realm of possibility that the correct amount for your employer to withhold from your pay is nothing.

If that French citizen, living and working in France, was to fill out Form W-4, they would follow these instructions, and write “Exempt” in the space below Step 4(c).

I’m using a French citizen as an extreme example to make a point. If you’re reading this, you’re likely living and working in one of the united States, so you have been told all your working life, or just assumed, that of course you are supposed to have some of your pay withheld so you don’t get dinged when you file your taxes.

Well, let us look into the law and see what it really says.2

Oh boy, here we go with another

Code Review:

U.S. CODE TITLE 26

INTERNAL REVENUE CODE

You can follow along yourself on the official government websites:

United States Code. Title 26 is the Internal Revenue Code.

I find the Cornell Law Website more user friendly.Code of Federal Regulations. Title 26 is Internal Revenue.

This one will be much shorter :)

Collection of Income Tax at Source

Section 3401: Definitions

There is an entire chapter on this. Title 26 > Subtitle C > Chapter 24 > Section 3401. We start with Definitions as usual, because remember the opinion of Mr. Justice Cardozo in the decision of Fox v. Standard Oil Co. of New Jersey, 294 US 87, 96 (1935):

[D]efinition by the average man, or even by the ordinary dictionary with its studied enumeration of subtle shades of meaning, is not a substitute for the definition set before us by the lawmakers with instructions to apply it to the exclusion of all others.3

The very first word defined is “wages”:

Ok, let us continue on in Section 3401 and look at the definitions for “employee” and “employer”

Now you chuckle and say, “But Arjun, all this says is that “employee” includes that. I’m an employee too, Obviously, because I was hired as an employee, so I’m also included! They just don’t say that in the code because it’s super obvious, it’s just common sense!”

The Supreme Court does not agree with you:

It is axiomatic that the statutory definition of the term excludes unstated meanings of that term. [Meese v. Keene, 481 U.S. 465 (1987)]4

Another important precedent set by Justice McReynolds who delivered the opinion of the court in Gould v. Gould, 245 US 151, 153 (1917) further shows that the Supreme Court does not agree with you:

In the interpretation of statutes levying taxes it is the established rule not to extend their provisions, by implication, beyond the clear import of the language used, or to enlarge their operations so as to embrace matters not specifically pointed out. In case of doubt they are construed most strongly against the Government, and in favor of the citizen.5

The law either says it, or it doesn’t. If it doesn’t, it’s not the law. And, it must be clear. If it is ambiguous, ambiguity is clarified in your favor. Further, if “employee” meant what it’s commonly taken to be, there would be no need to define the term in the code.

So, in conclusion, with regard to the law governing income taxes, you are an employee if you are an officer of, an employee6 of, or an elected official of the United States, a State, or any subsidiary, agency, or instrumentality. And, wages are what you get paid for such official work.7

Remember also the definitions of “United States” and “State”:

Nothing special to note in the definition of “employer” here:

So, let us move on to the next part:

Section 3402: Withholding Requirements

Employers making payment of “wages” shall deduct and withhold tax:

How is the amount determined?

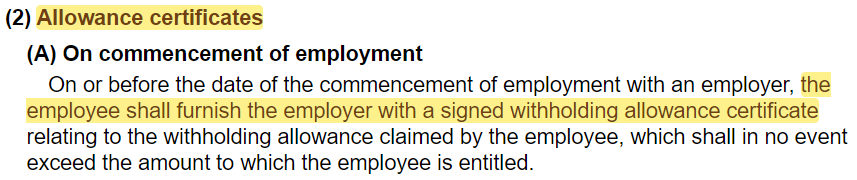

Ah, yes, the certificate furnished by the employee to the employer. The Form W-4.

It’s all coming full circle now.

Paragraph (n):

Matches exactly with the instructions found on Form W-4 we saw earlier.

Like I said earlier, this post stands on the shoulders of the great work done by the good people at Freedom Law School. They’ve got W-4 documents with all the law and education that you can provide to your employer if you are not an “employee” as defined by the Internal Revenue Code.

The best place to start though, in my opinion, is to research the income tax question further, then request clarification from your lawmakers. If you read the below article and see that you are not someone who is liable to the income tax by law, share your findings with your representatives in Congress and give them a chance to correct you. Of course, read and research everything first. Don’t take my or anyone else’s word for it.

The Income Tax Article You Shouldn't Read in 2024

Why were you confident in not wearing a mask when everybody else was? After it was established that it had nothing to do with keeping you safe, many people said, “It’s the LAW!” but you knew it was not the law. You studied the law and found that it was actually

Actually, from the worldly perspective, everything is progressing forward.

By the way, who do you think is actually going to spend the time doing this? Employers usually say they require these forms to be completed on your first day in order for you to get paid.

In this case the complainant took issue with a tax imposed on “stores” as defined by a bill passed by the legislature in 1933. Complainant, the oil company, thought it unfair that their payments accounted for 84.46% of the tax when they accounted for 4.6% of total business. The statute defined what “store” meant, and the quoted part in this article is referring to that argument.

Link to case: https://caselaw.findlaw.com/court/us-supreme-court/294/87.html

In this case, a member of the California State Senate, wished to show three Canadian films identified by the Department of Justice as “political propaganda,” but did not want to be publicly regarded as a disseminator of “political propaganda,” probably because it would hurt his chance for re-election. Again, the term “political propaganda” was defined in the statute.

Link to case: https://supreme.justia.com/cases/federal/us/481/465/

In this case, after the divorce of the Goulds, Mr. Gould was ordered to pay his ex-wife Mrs. Gould $3,000 per month for her “support and maintenance,” the question arose whether that alimony payment was part of Mrs. Goulds taxable income. The act of Congress in question had a list of income sources subject to be taxed, and alimony did not fit into any of those listed. Further, it was found that it was the “natural and legal duty of the husband to support the wife.”

Link to case: https://tile.loc.gov/storage-services/service/ll/usrep/usrep245/usrep245151/usrep245151.pdf

Recursive definition here lol

Makes complete sense. Remember the definition for “trade or business”:

26 USC 7701.(a)(26) Trade or business: The term "trade or business" includes the performance of the functions of a public office.