The Income Tax Article You Shouldn't Read

Part 3/3: US Code Title 26 Review | Who is liable to file and pay income taxes?

UPDATE (24 May 2024)

In this article, and other places, including on my Platform page, I imply that the income tax was established in 1913 with the establishment of the Federal Reserve and ratification of the 16th amendment.

I have found, on the website of Pete Hendrickson, that this is incorrect!

“These stories don’t mention that, in fact, huge portions of our modern body of income tax law pre-date the 16th Amendment, even though this is plainly stated in the preamble to the 1939 Internal Revenue Code, and even though Congress publishes a comprehensive derivation table explicitly identifying the pre-16th-origins of these still-current statutes. (See a little video presentation on this subject here.)” —https://losthorizons.com/The16th.htm

The income tax actually dates back to 1862. Here is that little video presentation:

Turns out the idea that the income tax started in 1913 with the 16th amendment is more distracting patriot mythology. The classic 99% truth and 1% lies that misleaders love to use.

However, this does not mean that the whole argument, nor this article, needs go down the toilet. There is STILL a conspiracy in place to have Americans think “income,” as defined by the IRC, means what they think it means in everyday language.

He explains it best himself:

But unfortunately, a mature scheme has been in place for about the last 70 years which is designed to trick those ignorant of the nuances of the law into inadvertently declaring their unprivileged earnings to be privileged, allowing the government to treat them as subject to the tax. You can learn all about how that works, how to keep from falling prey to this trick, and how to correct the ill effects of having fallen for this trick in the past, in ‘Cracking the Code- The Fascinating Truth About Taxation In America’.”

Original Article

Why were you confident in not wearing a mask when everybody else was?

After it was established that it had nothing to do with keeping you safe, many people said, “It’s the LAW!” but you knew it was not the law. You studied the law and found that it was actually against the law to require someone to wear a mask, whether for work or to enter a public business. A state crime and a federal crime.

“You can’t come in here without a mask!”

≡ Violation of CALIFORNIA CIVIL CODE Sec 51.5(a)

People who attended my How Not To Wear a Mask Workshop in 2021 researched the law and wrote up their own Notices of Violation to show businesses who had paper requirements for entry, citing Constitutional Law, State Law, and Federal Law.

Some great success was had stopping the madness at the point of enforcement. One friend reports many instances where he was able to get by shopping like a normal human being by saying, “You do know what you’re doing is illegal, right?”

Now that mask mandates are mostly over, people seem to have gone back to their normal lives. I told a friend back in the midst of the World Economic Shutdown of my prediction that as soon as the mandates were lifted, people go back to work, their regular lives, and go back to sleep. From what I can tell, that’s happened.

I’m sure there’s a small group of people adamant that “this can never be allowed to happen again.” There must be.

says there is:I asked the question back then, and I ask it again to you now:

How much of the American System do you want to restore?

If you get back the ability to breathe freely, feel safe, not be injected with strange substances, and not have your children woke propagandized is that all you want? Are you ok with all the other vampirical aspects of our current system continuing forever? Perhaps your education tells you that these vampirical aspects are important parts of our system, and we cannot do without them.

If you can live your life being left alone from Government intrusion, are you OK living within an oligarchical system? Many people are getting ready for that kind of life.

We are so deep into a fraudulent imperial system— what our founders had to fight physically to get away from— that what many think of as normal is anything but. What people think of as the solution to a problem actually exacerbates the problem. It’s not our fault, it’s not a system that any of us created. It was put in place before any of us were born. We’re used to living within it. That’s why America is still in startup phase, and will be until a significant minority of the population identify and act as People.

At the end of 2020 I started on a campaign to educate people about America. I found some great information— really great!— and wanted to share it with as many people as I could. A few were able to disconnect themselves from the constant stream of news bytes and opinion programming to learn and to think on that learning, and it shows.

The good news is this: The way you vitiate the corona fraud is the same way you vitiate the rest of the fraud: Sitting down and learning stuff. Lol.

So let me now ask you this question: If you knew that by law you were not required to file and pay income taxes, would you still do it?

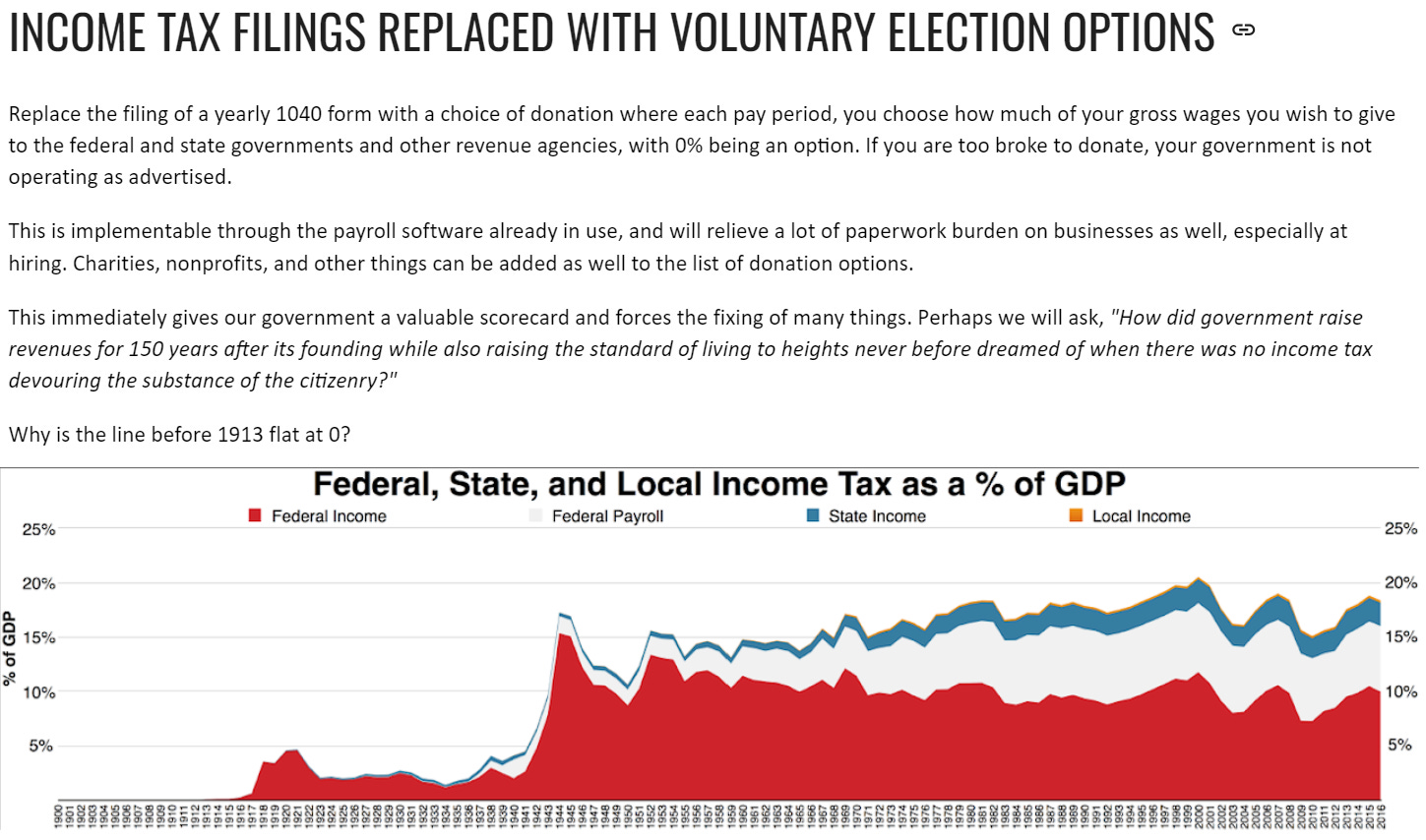

Do you need a politician to do it for you? Ok, well I ran for office, and I have this as one of the legislative priorities of my platform:

Think it’s totally different?

The thing you’d have to do is the same: nothing.

Not wear a mask

≡ Not file an income tax confession form

Doing nothing has become quite the crime these days.

Well, there is a difference. Masking was defined and started in 2020. Income taxing was defined in 1913 and refined over the last 111 years to what we have today. In your opinion, which practice has been more damaging to the society?

I’d like you to read the rest of this article and the two that follow as the devil’s advocate. Try to prove me wrong. I’m going to be taking actions on this, so if something doesn’t make sense to you, please call it out. You can do so by leaving a comment or send me an email.

Just because it makes sense to me doesn’t mean it makes sense in general. We’re all prone to getting stuck in echo chambers.

Remember, I taught the Constitution wrong for a long time without even realizing it, and people accepted what I said just because I was saying it.

I’m counting on you to apply your critical thinking and logical capabilities in this case. I’ve sent petitions to my representatives in the House and Senate asking them to do the same.1 If you or they can show that I’m mistaken in this article, I will put your and their arguments at the top of this article so that people who stumble across it know to not take it seriously.

There is also someone offering a $300,000 reward to anyone who can prove certain things about the tax laws. God bless.

This article is part 3 of a 3 part series. The three parts are:

Withholding Requirements according to USC Title 26: Internal Revenue Code

Income Tax Liability according to USC Title 26: Internal Revenue Code [This]

Yes, we’re starting at the last part and counting down to the first. The first thing people tend to do when this topic comes up is pull out the phone and do a quick search on Google, then shove the results in your face and call it a day. Google search results usually reference the lRS website and US Codes, so that’s where we’ll start.

Enjoy!

Let us begin.

This is going to be a long and tedious post, as a lot of code is referenced. If you do not have 30 minutes to go through it carefully now, I suggest bookmarking it and coming back later.

https://asodhani.substack.com/p/the-income-tax-article-you-shouldntCode Review:

U.S. CODE TITLE 26

INTERNAL REVENUE CODE

I will be calling out various parts of the code in this section.

You can follow along yourself on the official government websites:

United States Code. Title 26 is the Internal Revenue Code.

I find the Cornell Law Website more user friendly.Code of Federal Regulations. Title 26 is Internal Revenue.

FIRST - Who is liable to pay income tax?

First let us look at the very beginning.

Title 26 > Subtitle A > Chapter 1 > Subchapter A > Part I - Tax on Individuals

§1(c) - “There is hereby imposed on the taxable income of every individual… a tax determined in accordance with the following table

The first hint in this code section is what’s written in the parenthesis after the words “head of household.” The thing you should know is that the words used in statutes can have special meaning, different from the everyday language we use. Indeed, there are at least three types of English spoken in America.

The opinion of Mr. Justice Cardozo in the decision of Fox v. Standard Oil Co. of New Jersey, 294 US 87, 96 (1935) states:

[D]efinition by the average man, or even by the ordinary dictionary with its studied enumeration of subtle shades of meaning, is not a substitute for the definition set before us by the lawmakers with instructions to apply it to the exclusion of all others.2

And, from another case, Meese v. Keene, 481 U.S. 465 (1987), we find the opinion of Justice Stevens telling us:

It is axiomatic that the statutory definition of the term excludes unstated meanings of that term.3

Basically, if the statute uses words that it itself defines, we must use those definitions, even if they differ from commonly-understood definitions.

So, here in Part 1 we have some words that appear to need defining:

“married individual” - It says We can get the definition from section 7703

”individual”

“taxable income”

“head of household”

Let’s define each.

1. “married individual”

Ok, you’re a married individual if you’re married, except if your spouse dies or you’re divorced.

Makes sense so far, pretty str8forward.

2. “Individual“

Section 7701 has definitions for words “used in this title, where not otherwise distinctly expressed or manifestly incompatible with the intent thereof”

We actually don’t find a definition for “individual” in this section.

We do find definitions for “United States” and “State.” Please note these as we will come back to them later.

A word not defined within the title itself may be defined elsewhere. If we go to Title 1 (General Provisions) > Chapter 1 > Section 8, we find this, which I think is very interesting:

Are you a born alive infant member of the species homo sapiens at a stage of development? The way this is written, a 55 year old man can be considered an infant, as he has been born alive and is at some stage of development.

While this may help us understand why there seems to be so many manchilds running around all over the place, it doesn’t really tell us much with regard to our topic of interest.

So, let us go to the Code of Federal Regulations, to Title 26 > Volume 1 > Sec 1.1-1 Income tax on individuals, where we find:

“(a) General rule. (1) Section 1 of the Code imposes an income tax on the income of every individual who is a citizen or resident of the United States and, to the extent provided by section 871(b) or 877(b), on the income of a nonresident alien individual.”

…

“(b) Citizens or residents of the United States liable to tax. In general, all citizens of the United States, wherever resident, and all resident alien individuals are liable to the income taxes imposed by the Code whether the income is received from sources within or without the United States.”

Now we’re getting somewhere. We have here four types of individuals on which the income tax may be imposed:

citizens of the United States,

residents of the United States,

resident alien individuals, and

nonresident alien individuals, [only] to the extend provided in 871(b) and 877(b)

The first three are liable to income taxes whether the source of that income is “within or without the United States.” The fourth is liable to income taxes to the extent provided in section 871(b) or 877(b).

Again, let’s look at each.

1. Citizen of the United States

Remembering that Section 7701 has definitions for words “used in this title, where not otherwise distinctly expressed or manifestly incompatible with the intent thereof,” we can go there to start.

Subjection (a)(30):

So, a “citizen of the United States” and a “resident of the United States” is a “United States Person.” So now then, what is a “United States Person”?

Recall earlier we saw the definition for “United States”

“United States” includes the States and the District of Columbia [in a geographical sense].

“State” includes the District of Columbia.

Rewriting the definition for “United States” applying substitution: the [District of Columbia]s and the District of Columbia.

Ok, I hear you saying, “Gee, that sounds super retarded and a bit like grasping at straws. Makes no sense. Obviously, the word “States” in the definition for “United States” means ALL the 50 states, because the word is plural and obviously that’s what it means. That construction’s gotta be manifestly incompatible with the intent thereof.”

That’s what I thought too when first looking at the code. Two points:

Recall the court case you just saw. Words can have different meanings in the codes, and we must follow those definitions when reading the codes. (Of course, otherwise codes can be retroactively construed to mean anything just by changing the definition)

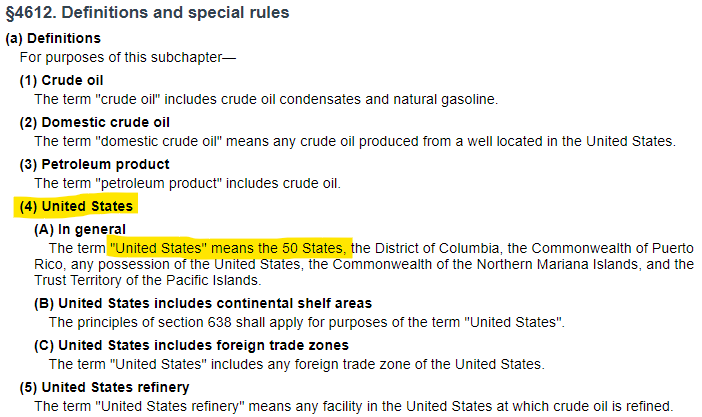

Section 4612 of the same Title, which is in Subtitle D dealing with Miscellaneous Excise Taxes, defines “United States” as such:

Title 26 > Subtitle D > Chapter 38 - Environmental TaxesThe definition of “United States” to be used in this subchapter is different from the definition of “United States” used in the rest of the Title. This definition of “United States” only applies to this subchapter.

In Subtitle A—Income Taxes we find several instances where “United States” is defined, all that apply to a particular paragraph, chapter, or part of the code.

So, question: If this definition…

… meant to include the 50 States, why not simply state that?4 Section 2 of the Part on Tax on Individuals, which is “Definitions and special rules,” would have been a great place to include the definition for “United States” if it meant to have a different definition for that part of the code. But it is not found.

Surely with all the people challenging commonly assumed ideas about the income taxes over the years, it would have been very easy for a congressman to introduce a bill changing the words in the code to clear up all this “confusion” once and for all.

I can’t imagine it’s that hard to make a simple amendment to the code to insert “50” in between “the” and “States” in the definition for “United States.” Why not do that and make it clear?

Is it because it doesn’t mean the 50 States?

2. Resident of the United States

Is a United States Person. What is that again?

Ah, ok. A citizen or resident of the District of Columbias and District of Columbia.5

3. Resident alien individual

For this, we go back to Section 7701 of course:

If such alien individual meets any of these three requirements, they shall be “treated as a resident of the United States [District of Columbia and District of Columbia].

Interesting to note that “alien” means “a foreigner; belonging to another country or nation.”

So, a foreign individual— one not local to the United States— shall be treated as a resident of the United States, if any of the three listed requirements are met.

Let’s have a look at (ii) Substantial presence test:

Basically dealing with the individual being in the United States [a/k/a District of Columbia] for a certain time. There are all kinds of new terms and exceptions introduced here, but let’s look a bit closer at subparagraph (B), which says, basically:

If you are not present in the United States [District of Columbia] for more than 183 days and have a tax home as per 911(d)(3) minus the second sentence:

Note how the struck sentence has to do with serving in support of the Armed Forces of the United States. How often does an everyday, normal working citizen serve in Presidentially declared combat zones?

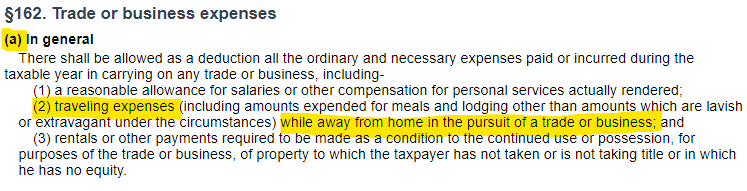

And section 162(a)(2), just for fun:

Keep in your brain the term “trade or business.” We’re going to come back to that in a short while. The more you read the code, the more it all makes sense… It’s all official government business baby!

Now let’s take a look at the third and final criteria, for being treated as a “resident of the United States [District of Columbia]”— (iii) First Year Election:

Interesting. An alien individual shall be treated as a resident of the United States if he so elects on his tax return.

A foreigner shall be liable to income tax if he says so.

Hey, If you declare that you owe me $10,000, that means you must owe me $10,000. Especially if you declare under penalty of perjury.

4. Nonresident alien individual

Now we want to find out what a “nonresident alien” is. This type of individual is subject to income tax to the extent provided by Section 871(b) and 877(b)

Again we start at Section 7701, same section as for Resident Alien Individual:

We figured as much since the terms are listed separately.

The income of nonresident aliens are taxed to the extend provided in Section 871(b) and 877(b). Let us go look at those sections

Section 871(b):

Note: there’s that term “trade or business” again.

Ok, so, a nonresident alien, who is not a citizen or resident of the District of Columbia,6 needs to pay tax on his taxable income which is connected with the conduct of a trade or business within the District of Columbia. His tax is as provided in section 1.

What is section 1?

We’ve come full circle. These are the tax brackets we’re all so familiar with.

What is section 55?

The Alternative Minimum Tax, which less of us are familiar with.

It’s now time we find out what trade or business means.

Let us go back to Section 7701:

Lol. Are you performing functions of a public office?

Let’s recap. A nonresident alien individual owes tax on his income that is connected with his conduct of the functions of a public office within the District of Columbia. Sounds like all Federal Government Trustees, employees, and contractors are subject to income tax, insofar as their income comes from the Federal Government.

This really makes all the sense in the world to me. Only employees of the company are subject the rules of that company. You don’t follow Coca Cola company bylaws unless you work for Coca Cola.

This also shows that the Income Tax is not unconstitutional, as so many claim. While it’s deceptive, it’s not illegal. It’s voluntary.

This makes a little more sense now, doesn’t it?

Now would be a good time to have a look at the 1862 Income Tax Return again.

Ok that was section 871(b). Now, let’s look at the other section which details to which extend a nonresident alien individual is subject to the income tax:

Section 877(b):

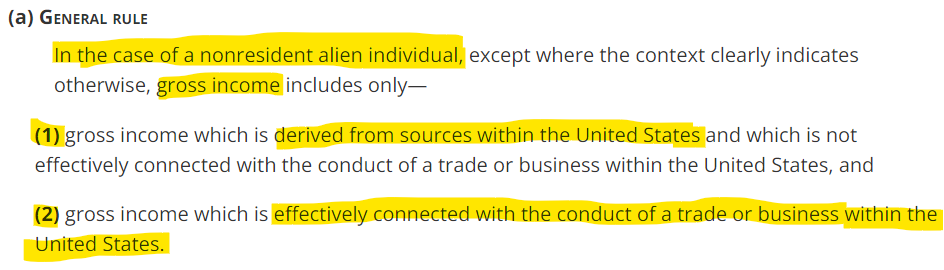

Now it gets to talking about “gross income,” and the description for that as it pertains to nonresident alien individuals is found in section 872(a):

If you, as a nonresident alien individual, set up a hotdog stand outside the Capitol Building, each hotdog sale counts towards your gross income, as per (1).

If you, as a nonresident alien individual, owning a hotdog company in Idaho, ship an order of $65k worth of hotdogs to the White House, that $65k counts towards gross income, as per (2).

3. “Head of Household”

We don’t need to define this for the purpose of this article. I think you get the point by now. You can find the definition in Section 2(b) if you’d like to check it out.

SECOND - Are you liable to pay income tax?

Well, I can’t answer that for you. That’s up to you to decide for yourself.

After all, you’re the you're the king.

This article was put together by big help from petitions that are part of Freedom Law School’s 1st Amendment Redress of Grievances campaign. There are DIY petitions you can download, fill out, and send to your representatives in Congress at freedomlawschool.org/step-5.

If you want to do the same, you can find example petitions here: https://www.freedomlawschool.org

In this case the complainant took issue with a tax imposed on “stores” as defined by a bill passed by the legislature in 1933. Complainant, the oil company, thought it unfair that their payments accounted for 84.46% of the tax when they accounted for 4.6% of total business. The statute defined what “store” meant, and the quoted part in this article is referring to that argument.

Link to case: https://caselaw.findlaw.com/court/us-supreme-court/294/87.html

In this case, a member of the California State Senate, wished to show three Canadian films identified by the Department of Justice as “political propaganda,” but did not want to be publicly regarded as a disseminator of “political propaganda,” probably because it would hurt his chance for re-election. Again, the term “political propaganda” was defined in the statute.

Link to case: https://supreme.justia.com/cases/federal/us/481/465/

Funny enough, on the official IRS web page having to do with the Substantial Presence Test, which we get to later in the article, tells us that “the term United States (U.S.) includes the following areas: All 50 states and the District of Columbia.” The website is a website. Why not update the code? For Google reasons?

See what I did there?

An exponent; Read: District of Columbia squared.

Thank you my friend.